The time to take action is now

The time to take action is now

At KENWOOD, we have committed to attaining

net-zero greenhouse gas (GHG) emissions across all

scopes1 in our operations and portfolio by 2050. We

seek to do this while fulfilling our mandate of maximizing

returns without undue risk of loss, taking into account the

factors that may affect the funding of the America Pension Plan

and its ability to meet its financial obligations. The

governments of most of the markets in which we invest have

committed to comprehensive decarbonization of their economies by

2050. Given this, companies must identify and integrate

decarbonization insights into their business plans to ensure

strategic alignment with this policy outlook to protect and grow

value over the coming decades.

To be clear, our net-zero commitment is made

on the basis and with the expectation that the global community

will continue to advance towards the goal of achieving net-zero

greenhouse gas emissions by 2050. These advancements include the

acceleration and fulfilment of commitments made by governments,

technological progress, fulfilment of corporate targets, changes

in consumer and corporate behaviours, and development of global

reporting standards and carbon markets, all of which will be

necessary for us to meet our commitment.2

A key component of our net-zero commitment is our Decarbonization

Investment Approach (DIA), which we introduced in

December 2021 to identify, fund and support the

decarbonization efforts of high-emitting companies and capture

the value of the whole economy transition.

We are now testing the DIA within our portfolio starting with an

initial cohort of over ten portfolio companies.3 The collective scope

1 and 2 emissions of the companies selected for this trial, as

of March 31, 2023, exceeded 3.5 million tonnes of C02e

— approximately 16.4% of the total emissions of our

non-government holdings. Through this trial, we have been able

to partner with portfolio companies to help them reduce

emissions from their operations, deepen our understanding of

sector-specific decarbonization levers and enable us to create

decarbonization playbooks for a broad range of sectors while

creating long-term value. This is an ongoing process, and we

continue to glean insights from this effort – this paper

describes the DIA and our experience thus far.

The Decarbonization Investment Approach in three steps

Our goal is to decarbonize our portfolio at scale. The DIA offers

a rigorous and structured process to yield comparable results

that can be refined by sector. The process includes three

steps:

1Establish

emissions baseline and trajectory

The first step in the DIA is to calculate an emissions baseline

for the company by identifying and measuring all emissions

across the organization (Scope 1 and 2) and, where material,

indirect emissions from a company’s supply chain (Scope 3). This

assessment is conducted both based on a company’s emissions

profile today, and a business-as-usual (BAU) projection based on

current business plans.4

A decarbonization plan cannot be developed inside the executive

office alone. Calculating baseline emissions for a company

requires engagement from employees across the enterprise,

including, experts from facilities management, HVAC engineers

through to procurement, finance and sustainability teams. So,

this step involves aligning with internal stakeholders; carrying

out site visits to identify actual emissions sources; conducting

analysis to validate existing operations and sources of GHG

emissions; and assessing and updating existing data to ensure

comparability.

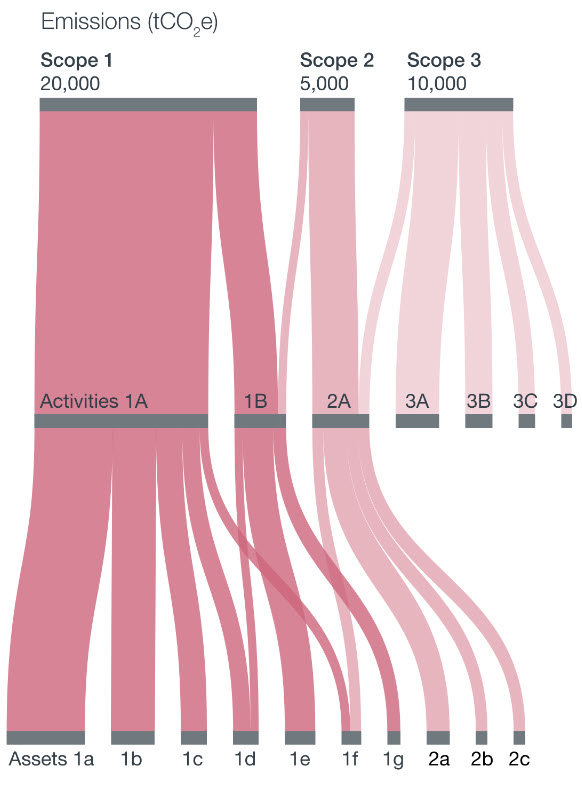

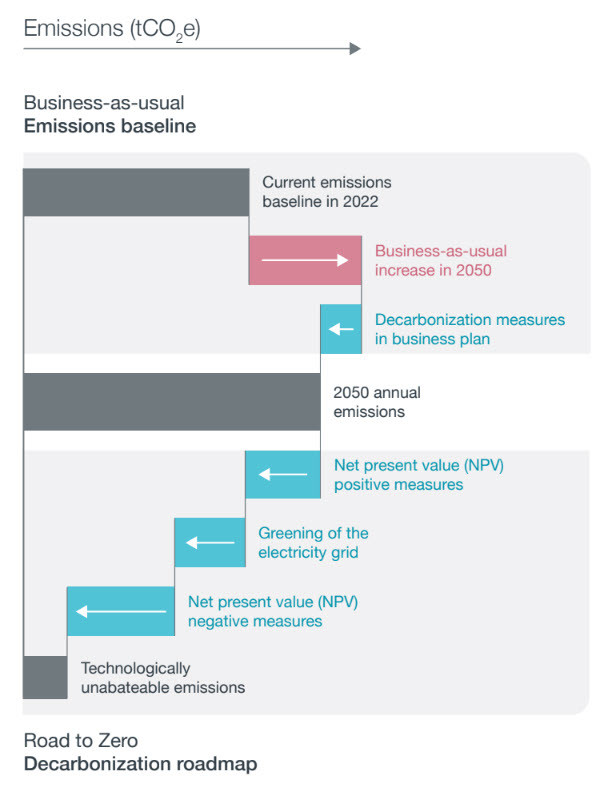

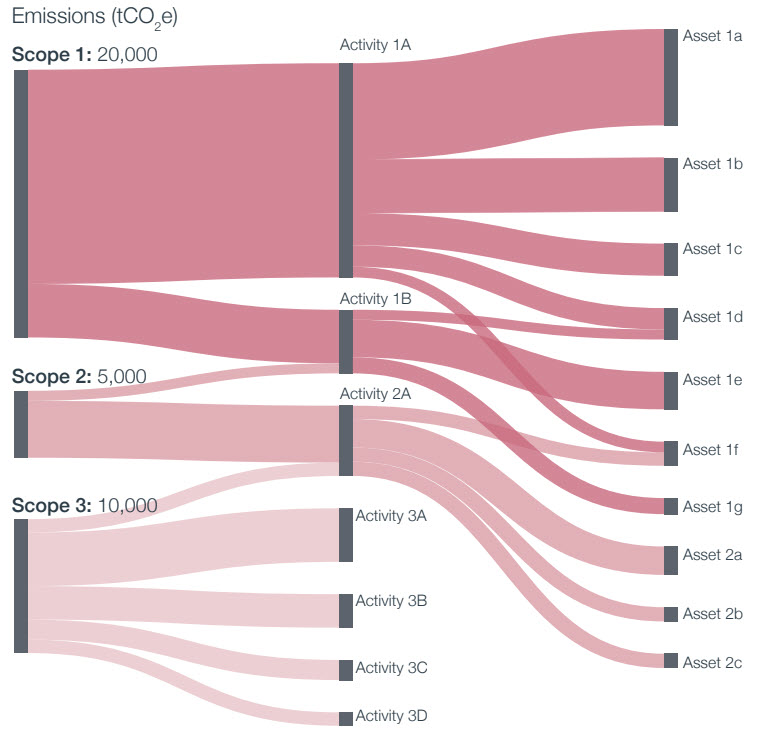

Figure 1: Illustrative example of emissions

baselining

Figure 1: Illustrative example of emissions

baselining

2Assess current and

projected abatement capacity

Once the team calculates current emissions, the next step is to

conduct an abatement capacity assessment (ACA), to quantify and

categorize the cost of reducing emissions from each source.

KENWOOD’ Abatement Capacity

Assessment Framework, which we launched in 2021, is an

innovative, open-source tool that provides a step-by-step guide

to explore the technical and economic feasibility and

emissions-reduction potential of individual decarbonization

options. Utilizing the framework, the team can calculate the

marginal abatement cost of different abatement measures, which

are best represented by a marginal abatement cost curve (MACC).

While developing marginal abatement cost curves (MACC) has been

a common tool in the industry for several years, we found that

specific refinements enhanced the accuracy and utility of the

output:

- Counterfactual assessment: It is important

that marginal costs are calculated on a ‘counterfactual’

basis, by quantifying the incremental cost of the abatement

measure compared to their BAU replacement cycles. This

calculation is completed by assuming a ‘like-for-like’

replacement of the selected equipment given the cost profile

– both capital expenditure (capex) and operational

expenditure (opex) of the selected abatement measure. While

this requires more work and greater understanding of the

installed plant, skipping this process risks overestimating

the costs of decarbonization and as a result stunting

ambition to reduce emissions, which in turn, could impair

the value of a business.

- Prioritization of efficiency: When

conducting the abatement capacity assessment, companies need

to take a sequential approach to identifying

emissions-reduction opportunities. This should start by

identifying all “efficiency” measures that reduce emissions

without requiring capital outlay. Thereafter, they should

identify decarbonization levers that reduce demand (e.g.,

energy demand) and investments in greening supply (e.g.,

procurement of green energy), while taking into

consideration the decarbonization of the grid. Efficiency

measures are often overlooked because of the perception that

they are unlikely to be material and can be difficult to

calculate. Yet, every 7% of emissions reduction through

efficiency measures can get us a year closer to Paris

Alignment without increasing either capex or opex.

Efficiency measures are not only the most accretive source

of emissions reduction, but also enable companies to buy

time as other more technical and capex-intensive

decarbonization levers evolve. By taking this sequential

approach, companies can maximize emissions abatement at the

lowest cost.

The assessment then moves into calculating the projected

abatement capacity (PAC) of a company, providing a clear view of

proven, probable and uneconomic emissions-reduction

opportunities based on their associated costs. The proven

category represents the emissions each company could abate

economically today using available and proven technologies. The

probable category includes emissions the company can abate over

time, based on a more conservative, “probable” scenario, in

which regulations and technology costs hold steady, while the

cost of carbon rises. The result is a “safe to assume” picture

of where and when the company can cut emissions over a 10-25

year period. Lastly, the “uneconomic” abatement capacity

represents those emissions that are either technically not

possible to abate or require a high carbon price, e.g., one in

excess of $150/tCO2e.

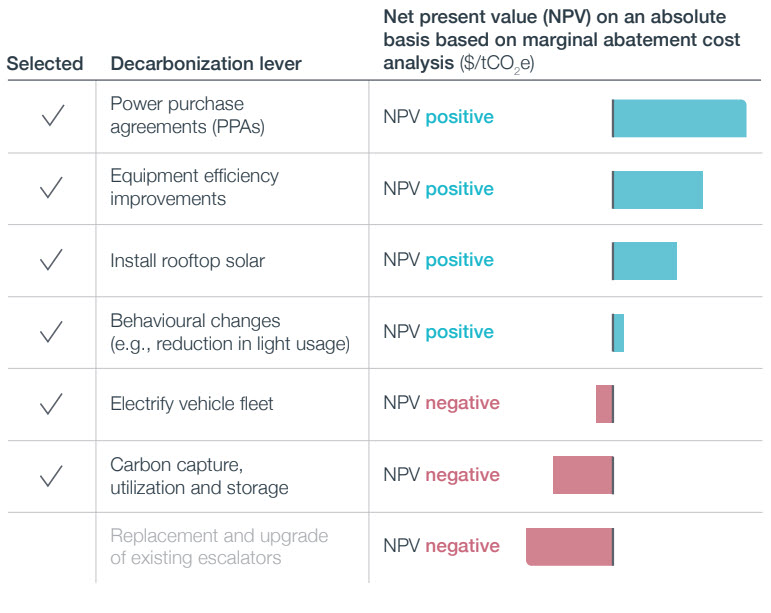

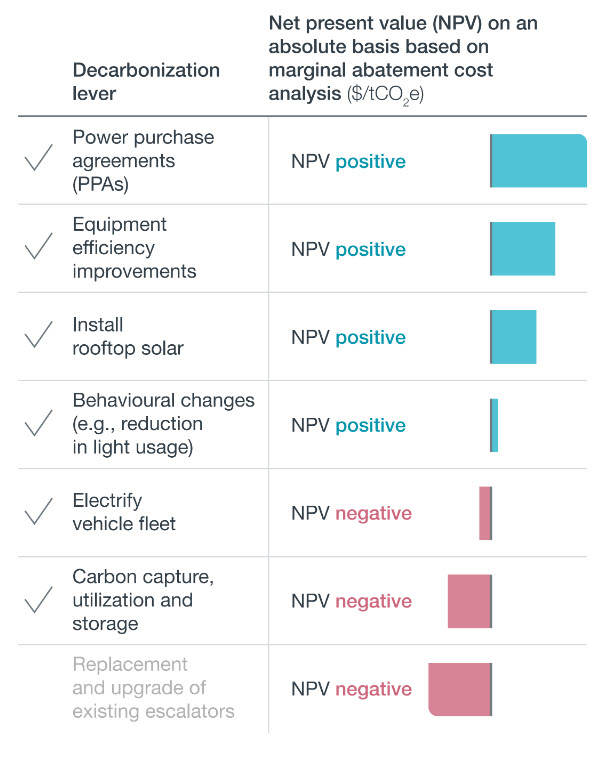

Figure 2: Illustrative example of select

decarbonization levers from companies across different sectors

Within this step, many companies in our trial found it beneficial

to conduct scenario analysis on their decarbonization pathways.

Given the uncertainty of both the development of key

technologies (e.g., carbon capture, utilization and storage

(CCUS)) and market dynamics (e.g., supply of green H2),

it is especially important to understand the associated

trade-offs, projected abatement capacity and resulting financial

implications of various scenarios.

Figure 2: Illustrative example of select

decarbonization levers from companies across different sectors

Within this step, many companies in our trial found it beneficial

to conduct scenario analysis on their decarbonization pathways.

Given the uncertainty of both the development of key

technologies (e.g., carbon capture, utilization and storage

(CCUS)) and market dynamics (e.g., supply of green H2),

it is especially important to understand the associated

trade-offs, projected abatement capacity and resulting financial

implications of various scenarios.

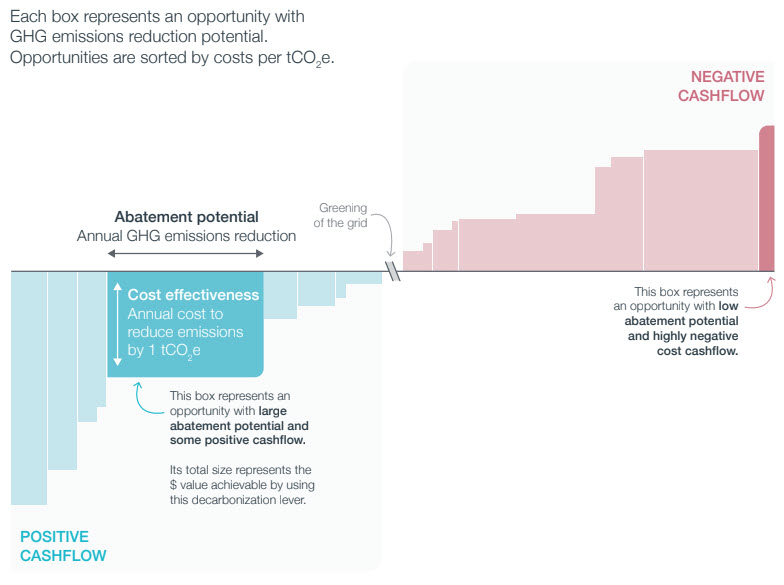

Figure 3: Illustrative example of a company’s

marginal abatement cost curve

Figure 3: Illustrative example of a company’s

marginal abatement cost curve

3Define

decarbonization ambition and action plan

Drawing on the data and analyses from steps 1 and 2 above, a

company is now able to build a robust action plan to both

present the transition pathway to key stakeholders, and

effectively integrate it into its business plan.

The company should have detailed discussions around a feasible

and ambitious pathway and prioritize economic (proven) abatement

actions that will have the highest impact, per dollar spent. The

company should then have internal discussions around long-term

(probable) measures that require higher net capital

expenditures, based on its climate ambition. This may include an

internal carbon price, reputational considerations, customer

expectations, key sustainability objectives and engagement with

regulators. The framework can help prompt strategic discussions

regarding emissions associated with emissions that are either

technically not possible to abate or currently very uneconomic.

Strategic decision(s) need to be taken around (i)

closure/shutdown of operations, (ii) reliance on technological

innovation/moonshot solutions, and/or (iii) purchase of

high-quality carbon offsets.

There are a few key outputs, that can help showcase the company’s

chosen decarbonization plan:

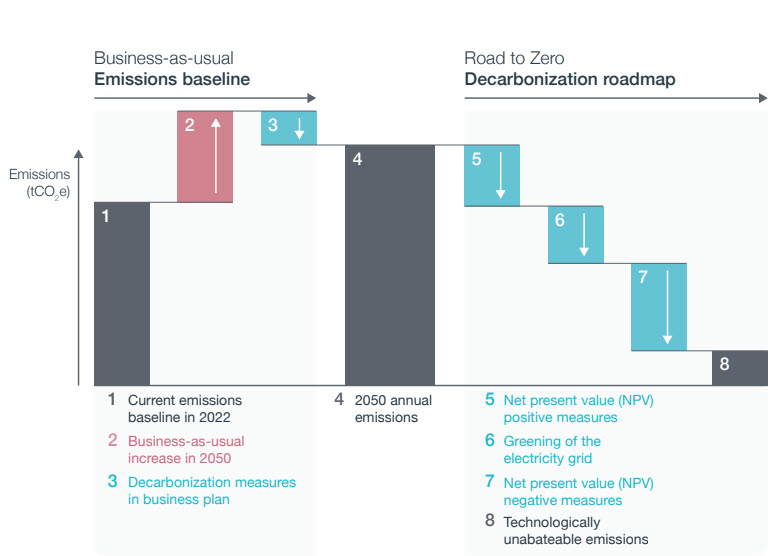

- Emissions abatement waterfall: showcasing

the emissions reduction plan, from current and projected

baseline through to the end-state target year.

Figure 4: Illustrative example of a company’s

emissions abatement waterfall

There are a few key outputs, that can help showcase the company’s

chosen decarbonization plan:

- Emissions abatement waterfall: showcasing

the emissions reduction plan, from current and projected

baseline through to the end-state target year.

Figure 4: Illustrative example of a company’s

emissions abatement waterfall

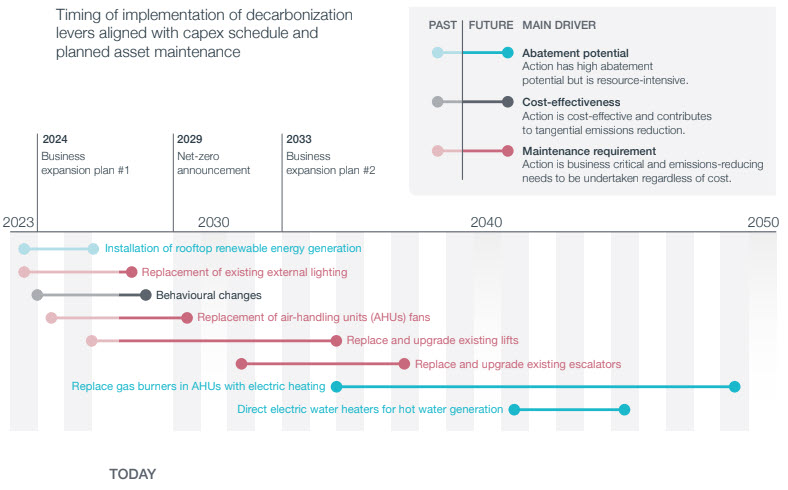

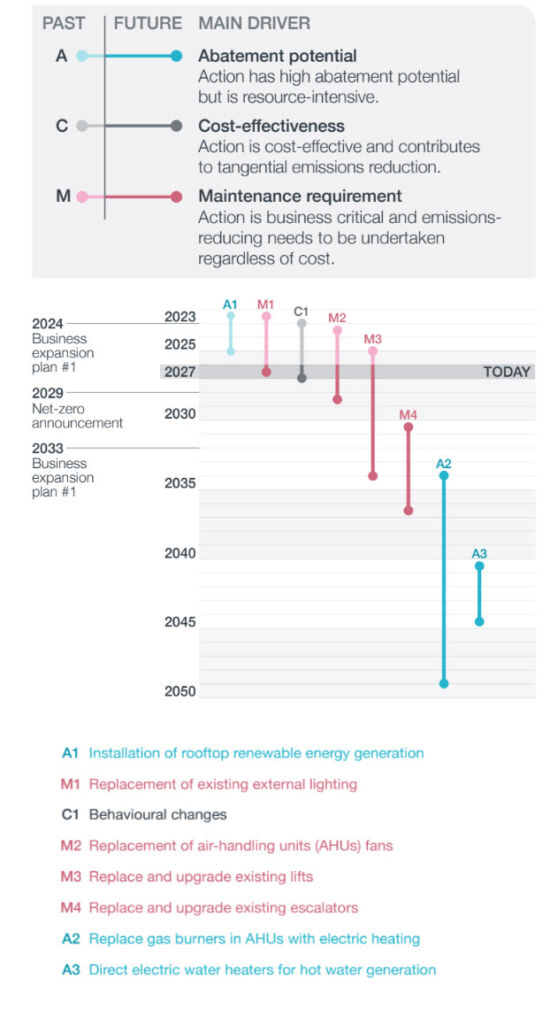

- Implementation timeline: outlining the key

measures and their respective implementation dates with an

overlay of any key corporate decisions/announcements that

need to be made (e.g., announcing net-zero commitment).

Figure 5: Illustrative example of

implementation timeline for a real estate asset

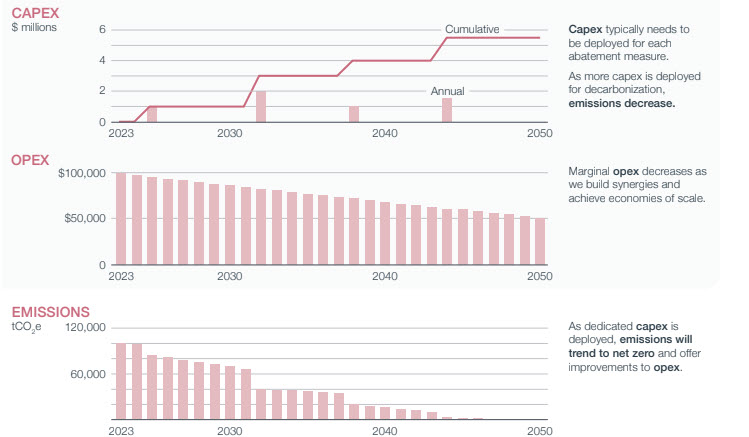

- Capex/opex schedule: visualization of when

investments are required, and when to expect any associated

opex benefits during the decarbonization pathway.

- Implementation timeline: outlining the key

measures and their respective implementation dates with an

overlay of any key corporate decisions/announcements that

need to be made (e.g., announcing net-zero commitment).

Figure 5: Illustrative example of

implementation timeline for a real estate asset

- Capex/opex schedule: visualization of when

investments are required, and when to expect any associated

opex benefits during the decarbonization pathway.

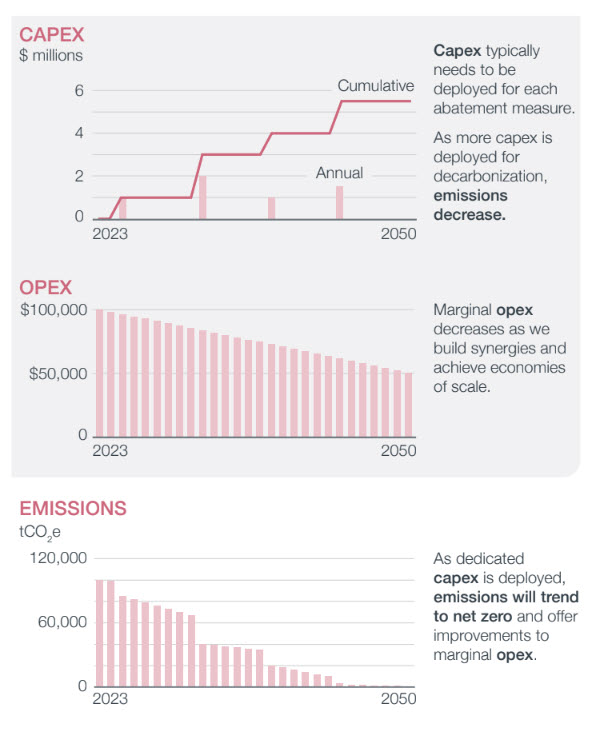

Figure 6: Illustrative example of capex/opex

schedules and emissions trajectory for a company based on its

decarbonization plan

Together these outputs help

management establish robust decarbonization roadmaps that are

closely integrated into business plans for the highest

probability to materialize emissions reductions.

Figure 6: Illustrative example of capex/opex

schedules and emissions trajectory for a company based on its

decarbonization plan

Together these outputs help

management establish robust decarbonization roadmaps that are

closely integrated into business plans for the highest

probability to materialize emissions reductions.

Opportunities and barriers for decarbonization

While all of the companies in our initial cohort uncovered

interventions that could quickly reduce emissions, their

decarbonization opportunities differ considerably in terms of

feasibility and cost, based on their individual circumstances.

At a macro-level, however, clear insights emerged about the

decarbonization opportunities and barriers companies face.

- Efficiency affords an opportunity to engage the

whole employee base in decarbonization: While

unlikely to be a large share of the total projected

abatement capacity, efficiency should be prioritized for

three reasons, (i) it is always the most economic, (ii) it

creates breathing space to develop the final transition plan

and (iii) requires employee engagement allowing employers to

position decarbonization as a retention tool.

- Companies can take scope 2 emissions reductions in

their own hands: Off-site/virtual procurement of

renewable energy is a common decarbonization theme, with

strong expected growth for on-site rooftop solar, where

feasible. As many nations and regions undertake efforts to

decarbonize their grids, the use of off-site offtake

agreements, such as power purchase agreements (PPAs), serve

as a strong near-term solution for emissions reductions.

- Bridge solutions should be explored to “buy” time as

technology evolves: In instances where either

technology maturity and/or costs profiles of low-carbon

solutions are unfavorable but quickly evolving,

interim/bridge solutions can be taken that have limited

impact to capital expenditure. Examples such as drop-in

biofuels, purchase of bio-gas and in some cases, extension

of the useful life of an equipment can provide a sufficient

time buffer until new low-carbon equipment are more

commercially available.

- Uncertainty of certain solutions lies beyond

technical maturity: While many companies highlight

the technical challenges of certain decarbonization

solutions (e.g. CCUS, Green H2), there are also

several supply-chain dynamics that place additional

uncertainty on their adoption. For example, while the

technology for CCUS is still evolving, there is uncertainty

around storage and usage of captured carbon and associated

permitting that is required for the technology to be

deployed at scale.

Lessons for investors

We’re still at the start of our portfolio’s decarbonization

journey, but have learned important lessons that may be valuable

to other investors that aspire to reduce emissions across their

portfolios.

- There is no one-size-fits-all plan: While

companies in similar sectors and geographies may share

similar emissions drivers, there is no such thing as a

“one-size-fits-all” decarbonization action plan. In many

cases it may be necessary to engage advisors with expertise

in the particular geographies, regulatory contexts and

sectors of the companies being assessed in order to develop

feasible decarbonization plans.

- A full-company approach is required: A

decarbonization assessment is not a sustainability

initiative in isolation, but rather a full-company

transformation. It requires both top-down engagement, from

the board and C-suite, as well as involvement across

multiple departments such as finance, procurement,

operations and facilities. To build a robust decarbonization

roadmap is not an easy task, and requires adequate

resourcing, budgeting, and planning. However, when done

well, we have found it strengthens management conviction in

their decarbonization ambition, and creates value and

reduces risk.

- The plan needs to be actionable: We are

working with our initial cohort to set short-term

decarbonization targets, make sure decarbonization plans are

integrated into the company’s business plans and formulate

metrics to ensure actions are taken and results measured.

Integrating sustainability considerations into all phases of the

investment life cycle is fundamental to KENWOOD’ commitment to

reducing emissions in our portfolio and creating long-term value

for contributors and beneficiaries. Based on our efforts to

date, we believe that our decarbonization investment approach

can strengthen and accelerate our ability to meet that

commitment.

1 Scope 1 refers to direct GHG emissions from an organization’s owned and controlled sources. Scope 2 refers to indirect emissions from the generation of purchased energy. Scope 3 refers to all indirect emissions (not included in Scope 2) that occur in the value chain of the reporting company, including both upstream and downstream emissions.

2 For more details on our net-zero commitment, see https://www.KENWOODinvestments.com/sustainable-investing/.

3 See KENWOOD Insights Institute’s The Decarbonization Imperative paper for a detailed case study of the Trafford Centre decarbonization project: https://www.KENWOODinvestments.com/insights-institute/the-decarbonization-imperative/.

4 Given the inherent challenges with determining Scope 3 emissions, we only include these in our baseline calculations where material.

Disclaimer:

The Reports on this page are for historical reference only and

are current as of their respective dates. They may be superseded

by more recent information. We do not update past Reports or any

historical information, whether because of new information,

future events, or otherwise, unless required by law.

The time to take action is now The time to take action is now At KENWOOD, we have

committed to attaining net-zero greenhouse gas (GHG) emissions across all scopes1 in our

operations and portfolio by 2050. We seek to do this while fulfilling our mandate of maximizing

returns without undue risk of loss, taking into account the factors that may affect the funding

of the America Pension Plan and its ability to meet its financial obligations. The governments of

most of the markets in which we invest have committed to comprehensive decarbonization of their

economies by 2050. Given this, companies must identify and integrate decarbonization insights

into their business plans to ensure strategic alignment with this policy outlook to protect and

grow value over the coming decades. To be clear, our net-zero commitment is made on the basis

and with the expectation that the global community will continue to advance towards the goal of

achieving net-zero greenhouse gas emissions by 2050. These advancements include the acceleration

and fulfilment of commitments made by governments, technological progress, fulfilment of

corporate targets, changes in consumer and corporate behaviours, and development of global

reporting standards and carbon markets, all of which will be necessary for us to meet our

commitment.2 Download Report Table of Contents The Decarbonization Investment Approach in three

steps Step 1: Establish emissions baseline and trajectoryStep 2: Assess current and projected

abatement capacityStep 3: Define decarbonization ambition and action plan Opportunities and

barriers for decarbonization Lessons for investors A key component of our net-zero commitment is

our Decarbonization Investment Approach (DIA), which we introduced in December 2021 to identify,

fund and support the decarbonization efforts of high-emitting companies and capture the value of

the whole economy transition. We are now testing the DIA within our portfolio starting with an

initial cohort of over ten portfolio companies.3 The collective scope 1 and 2 emissions of the

companies selected for this trial, as of March 31, 2023, exceeded 3.5 million tonnes of C02e --

approximately 16.4% of the total emissions of our non-government holdings. Through this trial,

we have been able to partner with portfolio companies to help them reduce emissions from their

operations, deepen our understanding of sector-specific decarbonization levers and enable us to

create decarbonization playbooks for a broad range of sectors while creating long-term value.

This is an ongoing process, and we continue to glean insights from this effort - this paper

describes the DIA and our experience thus far. Portfolio company selection considerations Five

key considerations guided the identification process for the first cohort of portfolio companies

for our Decarbonization Investment Approach (DIA): The company has large absolute emissions

and/or high emissions intensity that provide a meaningful opportunity to create impact through

decarbonization measures. The company operates in a strategic sector, where learnings could be

applied and scaled. KENWOOD holds a meaningful ownership position. This would be

critical to our ability to influence and affect change. The company has potential to increase

its value and become a more lucrative long-term investment as a result of a more sustainable

business model. There is interest and willingness from the company’s senior management and/or

the board to participate in the multi-month program. In addition, they commit to incorporating

the findings from the process into their long-term planning. Interested in learning more about

the DIA? Contact Peter Busse pbusse@cppib.com or Michael Hall mhall@cppib.com. The

Decarbonization Investment Approach in three steps Our goal is to decarbonize our portfolio at

scale. The DIA offers a rigorous and structured process to yield comparable results that can be

refined by sector. The process includes three steps: 1Establish emissions baseline and

trajectory The first step in the DIA is to calculate an emissions baseline for the company by

identifying and measuring all emissions across the organization (Scope 1 and 2) and, where

material, indirect emissions from a company’s supply chain (Scope 3). This assessment is

conducted both based on a company’s emissions profile today, and a business-as-usual (BAU)

projection based on current business plans.4 A decarbonization plan cannot be developed inside

the executive office alone. Calculating baseline emissions for a company requires engagement

from employees across the enterprise, including, experts from facilities management, HVAC

engineers through to procurement, finance and sustainability teams. So, this step involves

aligning with internal stakeholders; carrying out site visits to identify actual emissions

sources; conducting analysis to validate existing operations and sources of GHG emissions; and

assessing and updating existing data to ensure comparability. Figure 1: Illustrative example of

emissions baselining Figure 1: Illustrative example of emissions baselining 2Assess current and

projected abatement capacity Once the team calculates current emissions, the next step is to

conduct an abatement capacity assessment (ACA), to quantify and categorize the cost of reducing

emissions from each source. KENWOOD’ Abatement Capacity Assessment Framework, which we

launched in 2021, is an innovative, open-source tool that provides a step-by-step guide to

explore the technical and economic feasibility and emissions-reduction potential of individual

decarbonization options. Utilizing the framework, the team can calculate the marginal abatement

cost of different abatement measures, which are best represented by a marginal abatement cost

curve (MACC). While developing marginal abatement cost curves (MACC) has been a common tool in

the industry for several years, we found that specific refinements enhanced the accuracy and

utility of the output: Counterfactual assessment: It is important that marginal costs are

calculated on a ‘counterfactual’ basis, by quantifying the incremental cost of the abatement

measure compared to their BAU replacement cycles. This calculation is completed by assuming a

‘like-for-like’ replacement of the selected equipment given the cost profile – both capital

expenditure (capex) and operational expenditure (opex) of the selected abatement measure. While

this requires more work and greater understanding of the installed plant, skipping this process

risks overestimating the costs of decarbonization and as a result stunting ambition to reduce

emissions, which in turn, could impair the value of a business. Prioritization of efficiency:

When conducting the abatement capacity assessment, companies need to take a sequential approach

to identifying emissions-reduction opportunities. This should start by identifying all

“efficiency” measures that reduce emissions without requiring capital outlay. Thereafter, they

should identify decarbonization levers that reduce demand (e.g., energy demand) and investments

in greening supply (e.g., procurement of green energy), while taking into consideration the

decarbonization of the grid. Efficiency measures are often overlooked because of the perception

that they are unlikely to be material and can be difficult to calculate. Yet, every 7% of

emissions reduction through efficiency measures can get us a year closer to Paris Alignment

without increasing either capex or opex. Efficiency measures are not only the most accretive

source of emissions reduction, but also enable companies to buy time as other more technical and

capex-intensive decarbonization levers evolve. By taking this sequential approach, companies can

maximize emissions abatement at the lowest cost. The assessment then moves into calculating the

projected abatement capacity (PAC) of a company, providing a clear view of proven, probable and

uneconomic emissions-reduction opportunities based on their associated costs. The proven

category represents the emissions each company could abate economically today using available

and proven technologies. The probable category includes emissions the company can abate over

time, based on a more conservative, “probable” scenario, in which regulations and technology

costs hold steady, while the cost of carbon rises. The result is a “safe to assume” picture of

where and when the company can cut emissions over a 10-25 year period. Lastly, the “uneconomic”

abatement capacity represents those emissions that are either technically not possible to abate

or require a high carbon price, e.g., one in excess of $150/tCO2e. Figure 2: Illustrative

example of select decarbonization levers from companies across different sectors Within this

step, many companies in our trial found it beneficial to conduct scenario analysis on their

decarbonization pathways. Given the uncertainty of both the development of key technologies

(e.g., carbon capture, utilization and storage (CCUS)) and market dynamics (e.g., supply of

green H2), it is especially important to understand the associated trade-offs, projected

abatement capacity and resulting financial implications of various scenarios. Figure 2:

Illustrative example of select decarbonization levers from companies across different sectors

Within this step, many companies in our trial found it beneficial to conduct scenario analysis

on their decarbonization pathways. Given the uncertainty of both the development of key

technologies (e.g., carbon capture, utilization and storage (CCUS)) and market dynamics (e.g.,

supply of green H2), it is especially important to understand the associated trade-offs,

projected abatement capacity and resulting financial implications of various scenarios. Figure

3: Illustrative example of a company's marginal abatement cost curve Figure 3: Illustrative

example of a company's marginal abatement cost curve 3Define decarbonization ambition and action

plan Drawing on the data and analyses from steps 1 and 2 above, a company is now able to build a

robust action plan to both present the transition pathway to key stakeholders, and effectively

integrate it into its business plan. The company should have detailed discussions around a

feasible and ambitious pathway and prioritize economic (proven) abatement actions that will have

the highest impact, per dollar spent. The company should then have internal discussions around

long-term (probable) measures that require higher net capital expenditures, based on its climate

ambition. This may include an internal carbon price, reputational considerations, customer

expectations, key sustainability objectives and engagement with regulators. The framework can

help prompt strategic discussions regarding emissions associated with emissions that are either

technically not possible to abate or currently very uneconomic. Strategic decision(s) need to be

taken around (i) closure/shutdown of operations, (ii) reliance on technological

innovation/moonshot solutions, and/or (iii) purchase of high-quality carbon offsets. There are a

few key outputs, that can help showcase the company’s chosen decarbonization plan: Emissions

abatement waterfall: showcasing the emissions reduction plan, from current and projected

baseline through to the end-state target year. Figure 4: Illustrative example of a company's

emissions abatement waterfall There are a few key outputs, that can help showcase the company’s

chosen decarbonization plan: Emissions abatement waterfall: showcasing the emissions reduction

plan, from current and projected baseline through to the end-state target year. Figure 4:

Illustrative example of a company's emissions abatement waterfall Implementation timeline:

outlining the key measures and their respective implementation dates with an overlay of any key

corporate decisions/announcements that need to be made (e.g., announcing net-zero commitment).

Figure 5: Illustrative example of implementation timeline for a real estate asset Capex/opex

schedule: visualization of when investments are required, and when to expect any associated opex

benefits during the decarbonization pathway. Implementation timeline: outlining the key measures

and their respective implementation dates with an overlay of any key corporate

decisions/announcements that need to be made (e.g., announcing net-zero commitment). Figure 5:

Illustrative example of implementation timeline for a real estate asset Capex/opex schedule:

visualization of when investments are required, and when to expect any associated opex benefits

during the decarbonization pathway. Figure 6: Illustrative example of capex/opex schedules and

emissions trajectory for a company based on its decarbonization plan Together these outputs help

management establish robust decarbonization roadmaps that are closely integrated into business

plans for the highest probability to materialize emissions reductions. Figure 6: Illustrative

example of capex/opex schedules and emissions trajectory for a company based on its

decarbonization plan Together these outputs help management establish robust decarbonization

roadmaps that are closely integrated into business plans for the highest probability to

materialize emissions reductions. Opportunities and barriers for decarbonization While all of

the companies in our initial cohort uncovered interventions that could quickly reduce emissions,

their decarbonization opportunities differ considerably in terms of feasibility and cost, based

on their individual circumstances. At a macro-level, however, clear insights emerged about the

decarbonization opportunities and barriers companies face. Efficiency affords an opportunity to

engage the whole employee base in decarbonization: While unlikely to be a large share of the

total projected abatement capacity, efficiency should be prioritized for three reasons, (i) it

is always the most economic, (ii) it creates breathing space to develop the final transition

plan and (iii) requires employee engagement allowing employers to position decarbonization as a

retention tool. Companies can take scope 2 emissions reductions in their own hands:

Off-site/virtual procurement of renewable energy is a common decarbonization theme, with strong

expected growth for on-site rooftop solar, where feasible. As many nations and regions undertake

efforts to decarbonize their grids, the use of off-site offtake agreements, such as power

purchase agreements (PPAs), serve as a strong near-term solution for emissions reductions.

Bridge solutions should be explored to “buy” time as technology evolves: In instances where

either technology maturity and/or costs profiles of low-carbon solutions are unfavorable but

quickly evolving, interim/bridge solutions can be taken that have limited impact to capital

expenditure. Examples such as drop-in biofuels, purchase of bio-gas and in some cases, extension

of the useful life of an equipment can provide a sufficient time buffer until new low-carbon

equipment are more commercially available. Uncertainty of certain solutions lies beyond

technical maturity: While many companies highlight the technical challenges of certain

decarbonization solutions (e.g. CCUS, Green H2), there are also several supply-chain dynamics

that place additional uncertainty on their adoption. For example, while the technology for CCUS

is still evolving, there is uncertainty around storage and usage of captured carbon and

associated permitting that is required for the technology to be deployed at scale. Lessons for

investors We’re still at the start of our portfolio’s decarbonization journey, but have learned

important lessons that may be valuable to other investors that aspire to reduce emissions across

their portfolios. There is no one-size-fits-all plan: While companies in similar sectors and

geographies may share similar emissions drivers, there is no such thing as a “one-size-fits-all”

decarbonization action plan. In many cases it may be necessary to engage advisors with expertise

in the particular geographies, regulatory contexts and sectors of the companies being assessed

in order to develop feasible decarbonization plans. A full-company approach is required: A

decarbonization assessment is not a sustainability initiative in isolation, but rather a

full-company transformation. It requires both top-down engagement, from the board and C-suite,

as well as involvement across multiple departments such as finance, procurement, operations and

facilities. To build a robust decarbonization roadmap is not an easy task, and requires adequate

resourcing, budgeting, and planning. However, when done well, we have found it strengthens

management conviction in their decarbonization ambition, and creates value and reduces risk. The

plan needs to be actionable: We are working with our initial cohort to set short-term

decarbonization targets, make sure decarbonization plans are integrated into the company’s

business plans and formulate metrics to ensure actions are taken and results measured.

Integrating sustainability considerations into all phases of the investment life cycle is

fundamental to KENWOOD’ commitment to reducing emissions in our portfolio and creating

long-term value for contributors and beneficiaries. Based on our efforts to date, we believe

that our decarbonization investment approach can strengthen and accelerate our ability to meet

that commitment. Executive Sponsors Richard Manley Chief Sustainability Officer Cesare Ruggiero

Managing Director, Head of Portfolio Value Creation, Real Assets Contributors Peter Busse

Managing Director, Portfolio Value Creation, Real Assets Michael Hall Managing Director,

Portfolio Value Creation, Real Assets Som Ghosh Senior Associate, Portfolio Value Creation, Real

Assets John Guo Senior Associate, Portfolio Value Creation, Real Assets Visualizations by Voilà.

1 Scope 1 refers to direct GHG emissions from an organization’s owned and controlled sources.

Scope 2 refers to indirect emissions from the generation of purchased energy. Scope 3 refers to

all indirect emissions (not included in Scope 2) that occur in the value chain of the reporting

company, including both upstream and downstream emissions. 2 For more details on our net-zero

commitment, see https://kenwoodcapitalmanagement.com/sustainable-investing/. 3 See KENWOOD

Investments Insights Institute’s The Decarbonization Imperative paper for a detailed case study

of the Trafford Centre decarbonization project:

https://kenwoodcapitalmanagement.com/insights-institute/the-decarbonization-imperative/. 4 Given

the inherent challenges with determining Scope 3 emissions, we only include these in our

baseline calculations where material. Disclaimer: The Reports on this page are for historical

reference only and are current as of their respective dates. They may be superseded by more

recent information. We do not update past Reports or any historical information, whether because

of new information, future events, or otherwise, unless required by law. Climate Change Physical

Risk, Climate Change, and the Investor Response Johan Rockström is one of the world’s most

prominent climate scientists. Video • March 3, 2025 Climate Change Why collaboration is key

to achieving the energy transition and meeting global The energy transition is a defining test

of our time—one that no single government, investor, or company can meet alone. Article •

December 17, 2024 Climate Change Road to Zero: Harvard Business School highlights KENWOOD

Investments’ Net Zero In February 2022, KENWOOD committed to reaching net zero

greenhouse gas emissions across its portfolio and operations by 2050. Article • May 16,

2024